Exploring Bitstamp’s ETH/BTC Trading Pair: Opportunities and Analysis

Exploring Bitstamp’s ETH/BTC Trading Pair: Opportunities and Analysis

Understanding Bitstamp’s ETH/BTC Trading Pair

Bitstamp, one of the leading cryptocurrency exchanges, offers a wide range of trading pairs to its users. Among them, the ETH/BTC trading pair has gained significant popularity in recent times. This trading pair allows users to exchange Ethereum (ETH) for Bitcoin (BTC) and vice versa. In this blog post, we will dive deep into the opportunities and analysis of trading ETH/BTC on Bitstamp.

The Opportunities with ETH/BTC Trading on Bitstamp

Bitstamp’s ETH/BTC trading pair opens up several opportunities for both experienced traders and newcomers in the cryptocurrency market. Let’s explore some of these opportunities:

Arbitrage Possibilities

Arbitrage is a trading strategy that involves buying an asset at a lower price on one exchange and selling it at a higher price on another. With Bitstamp’s ETH/BTC trading pair, traders can take advantage of price discrepancies between the two cryptocurrencies on different exchanges. By carefully monitoring the prices and executing quick trades, one can potentially make profits with arbitrage opportunities.

Portfolio Diversification

Trading ETH/BTC on Bitstamp allows traders to diversify their cryptocurrency portfolio. While Bitcoin is known for its store-of-value and status as a digital gold, Ethereum offers opportunities in decentralized applications and smart contracts. By trading between these two cryptocurrencies, traders can take advantage of the benefits offered by both.

Market Volatility

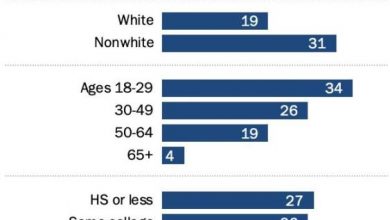

Volatility in the cryptocurrency market presents opportunities for traders to profit from price movements. The ETH/BTC trading pair on Bitstamp provides an avenue to capitalize on price fluctuations in both Ethereum and Bitcoin. Traders can employ various strategies, such as technical analysis, to identify trends and make informed trading decisions.

Analysis of the ETH/BTC Trading Pair

Analyzing the ETH/BTC trading pair can help traders understand the market dynamics and make better trading decisions. Here are some factors to consider:

Technical Analysis

Technical analysis involves studying historical price and volume data to predict future price movements. Traders can use indicators, charts, and patterns to identify trends, support and resistance levels, and potential entry and exit points for their trades. Implementing technical analysis tools can improve the probability of successful trades.

Fundamental Analysis

Fundamental analysis focuses on evaluating the underlying factors that can impact the value of cryptocurrencies. Factors such as news, market sentiment, regulatory developments, and technological advancements can influence the ETH/BTC trading pair. Staying informed about these fundamental factors can help traders make more informed decisions.

Frequently Asked Questions (FAQs)

1. Is Bitstamp a reliable cryptocurrency exchange?

Yes, Bitstamp is one of the longest-standing exchanges in the cryptocurrency industry, with a track record of secure operations and customer satisfaction. It is regulated and licensed, providing users with a trusted platform for trading cryptocurrencies.

2. How can I start trading the ETH/BTC pair on Bitstamp?

To start trading the ETH/BTC pair on Bitstamp, you need to create an account on the Bitstamp platform. Once registered, you can deposit funds into your account and then execute trades by placing buy or sell orders for the ETH/BTC pair. Bitstamp offers a user-friendly interface and various order types to suit different trading strategies.

3. What are the trading fees on Bitstamp?

Bitstamp’s fee structure depends on the trading volume and type of order executed. For more details, you can visit the Bitstamp website and review their fee schedule.

4. Are there any risks involved in trading the ETH/BTC pair?

As with any trading activity, there are inherent risks involved when trading the ETH/BTC pair on Bitstamp or any other platform. It’s important to conduct thorough research, manage risk effectively, and be cautious with your investments. Diversifying your portfolio and using proper risk management techniques can help mitigate these risks.

In conclusion, exploring Bitstamp’s ETH/BTC trading pair can provide traders with various opportunities for profit and portfolio diversification. By conducting analysis and staying informed about market trends, traders can make better-informed trading decisions. Remember to approach cryptocurrency trading with caution and always do your own research before making any investments.

Disclaimer: This article does not constitute financial advice. Trading cryptocurrencies involves risks, and it is essential to consult a professional financial advisor before making any investment decisions.